Medicaid Spenddowns: What Families Need to Know

Medicaid Spenddowns: What Families Need to Know

Medicaid can be a vital lifeline for older adults who need long-term care, especially when the cost of nursing homes or in-home care becomes overwhelming. However, qualifying for Medicaid often requires something called a “spenddown.” Many families aren’t familiar with the term until they’re suddenly faced with it. This guide explains what a spenddown is, what someone can legally spend their money on, and how to avoid mistakes that can cause delays or penalties.

What Is a Medicaid Spenddown?

A Medicaid spenddown is the process of reducing a person’s countable assets to the limit allowed by MassHealth, the Medicaid program in Massachusetts.

For a single individual applying for long-term-care Medicaid, the asset limit is generally low. If they have more than the allowable amount, they must “spend down” the excess before they can qualify.

It’s important to note:

A spenddown is not about getting rid of money to look poor. It’s about using assets appropriately and legally for the person’s benefit.

What Can Someone Spend Money On?

MassHealth allows applicants to use their own funds for

goods and services that directly benefit them. Common and fully allowed spenddown expenses include:

• Funeral and burial plans (preneed arrangements and burial accounts)

• Outstanding bills and debts

• Medical bills, prescriptions, vision and dental care

• Home repairs or safety improvements (roofing, plumbing, accessibility modifications, appliances)

• Clothing, personal care items, and furniture

• Hearing aids, glasses, walkers, wheelchairs

• Rent or mortgage payments

• Legal fees related to estate or Medicaid planning

• Health insurance premiums

• Prepaying for future care or equipment they will need

These expenses are legitimate because they improve the applicant’s health, comfort, or safety.

Purchases MassHealth Does Not Allow

Some expenses will trigger penalties or delays if they look like a gift or transfer. Avoid:

• Giving money to family or friends

• Selling assets for less than fair market value

• Transferring a car or home to someone else

• Paying someone informally for caregiving without a written agreement

• Making donations or charitable gifts

MassHealth reviews the last 5 years of financial history for long-term-care applications, so improper transfers can be costly.

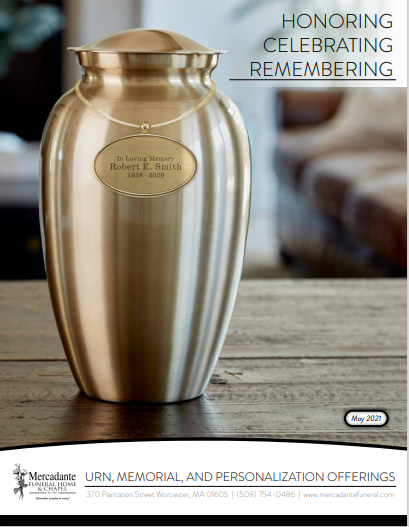

Funeral and Burial Spenddowns

One of the most overlooked and beneficial spenddown options is prepaying funeral arrangements. MassHealth allows fully prepaid, irrevocable funeral contracts.

Families often choose:

• Burial or cremation services

• Casket or urn

• Outer burial container

• Cemetery expenses (if paid directly)

• Memorial merchandise and cash advances held in trust

This protects the applicant’s eligibility and removes emotional and financial burdens from the family later.

Spenddown Tips to Avoid Delays

• Keep all receipts, invoices, and contracts.

• Use checks or bank-verified payments—avoid cash.

• Keep spending tied to the person’s needs.

• Consult an elder-law attorney if there are major assets involved.

• Do not wait until the last minute—processing times are slow.

Why Spenddowns Matter

When handled properly, a Medicaid spenddown helps individuals qualify for essential care while improving their quality of life. Families often feel relieved knowing the money was used to support their loved one instead of becoming a penalty later.

If you or someone you care about has questions about preplanning funeral arrangements as part of a Medicaid spenddown, guidance is available. Understanding the rules now can prevent expensive mistakes and provide peace of mind when it matters most.